The WIFPR Blog publishes posts spotlighting research by members of the Wharton community. In this post, Anna Helmke, PhD candidate in Finance, discusses her work on ETFs and mutual funds.

By Anna Helmke

The rise of passive investing has been nothing short of revolutionary. At the heart of this phenomenon lies the idea that the average investor is best served by simply investing in a diversified index of securities. Within the passive investment space, investors can choose between index exchange-traded funds (ETFs) and open-end mutual funds. Both funds perform liquidity transformation, hold identical portfolios, charge similar fees and control nearly equal shares of the over $9 trillion index fund market.

Yet, ETFs and mutual funds differ quite substantially in the ways they are traded and priced in financial markets. ETFs are traded on exchange intraday at the prevailing market price, just like stocks, while mutual funds are purchased or redeemed directly from the fund company at the end of day fund net asset value (NAV), as shown in Figure 1. From the prior literature it remains unclear how these differences affect investors’ payoffs and financial stability risks.

In my recent paper, I establish the surprising result that ETFs holding less liquid securities, such as corporate bonds or international equities, provide lower payoffs to investors who must sell at short notice during periods of market stress compared to same-index mutual funds. I propose a discrete-time, three-period portfolio choice model built on Diamond and Dybvig (1983). In this model, rational investors, each facing a different probability of needing to sell fund shares prematurely, allocate their wealth between an ETF and mutual fund that track the same benchmark index.

Figure 1. Trading in ETF and open-end mutual fund shares

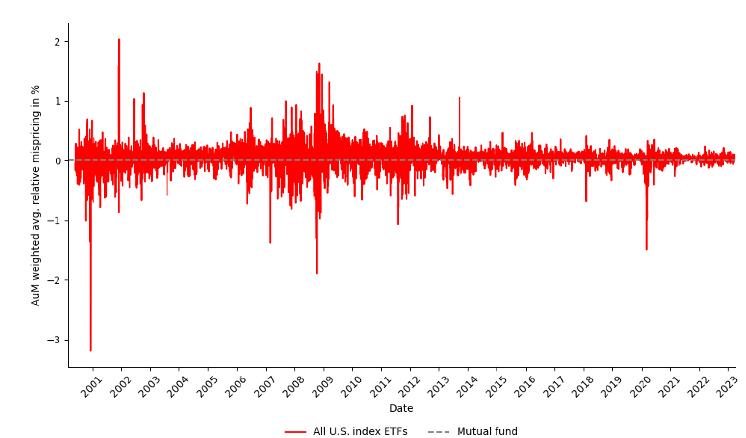

I present three primary results. First, the greater flexibility of ETF prices together with the potential for relative mispricing between the ETF market price and its underlying portfolio net asset value can lower investors’ returns when they need to sell fund shares at short notice (i.e., within a few days) during times of market stress. Empirically, during the Covid-19 market sell-off in March 2020, U.S. based index ETFs traded at discounts of up to 130 basis points on an asset weighted basis, as Figure 2 shows.

Figure 2. Relative mispricing of U.S. index ETFs in % NAV

In contrast, mutual funds’ guaranteed redemption at the fund NAV provides investors with short-term liquidity insurance. Yet, this short-term liquidity insurance comes at a cost. The staleness in mutual fund NAVs gives rise to externalities among investors which can decrease fund payoffs for the remaining mutual fund investors over the long term (i.e., over a period of several years). Thereby, outflows from ETFs only have temporary effects on investors’ payoffs, whereas mutual fund flows can have persistent effects on investors’ payoffs.

Second, I show that ETFs’ market-based pricing mechanism gives rise to “reverse run” incentives. When more investors want to sell ETFs than buy, ETF prices drop. This encourages shareholders to remain invested, or even buy additional ETF shares, especially at times when banks acting as central liquidity providers in ETF markets (authorized participants) are balance sheet capacity constrained. The tighter the balance sheet constraints are, the less liquidity ETFs provide to short-term investors.

Third, I show that investors who can flexibly time their fund redemptions should prefer ETFs. They are not worried about short-term mispricing risk and don’t want to be the ones subsidizing short-term redemptions in mutual funds. Investors with potential urgent liquidity needs prefer open-end mutual funds because they value the guaranteed redemption at NAV.

These insights can inform decision-making processes for investors, regulatory authorities, and asset managers. First, this study offers implications for index fund selection within retirement accounts, an area of paramount significance. To avoid a scenario where retirement investors in illiquid index mutual funds during the wealth accumulation phase inadvertently subsidize short-term liquidity provision to retirees and non-retirement account holders, retirement plan sponsors should add ETFs to the menu of investment options.

Beyond this, regulators may even consider a novel “target-date” fund design. The current notion of target-date funds focuses on the margin of debt versus equity. My framework implies that a new margin of mutual funds versus ETFs should also be incorporated into the design of retirement accounts. As an investor ages and becomes more exposed to short-term liquidity shocks, her portfolio should drift from ETFs to mutual funds, everything else equal.

Second, an awareness of investors’ trade-offs between ETFs and mutual funds can further assist regulators in designing fund liquidity management tools. In my model, mutual funds are subject to run risk. ETFs’ market-based pricing mechanism discourages early redemptions by patient investors but imposes excessive liquidation costs on impatient investors. One potential tool to reduce flow-induced share dilution, and therefore run risk in open-end mutual funds is swing pricing. Swing pricing is a mechanism that adjusts mutual funds’ NAVs to account for flow-induced transaction costs, thereby protecting remaining shareholders’ interests.

In November 2022, the SEC proposed to make swing pricing mandatory for most U.S. based open-end mutual funds, sparking vehement criticism from both asset managers and politicians. Many market participants argue that swing pricing, in voluntarily swinging down the NAV offered to redeeming investors, may hurt mutual funds’ appeal to investors.

On the contrary, my results imply that swing pricing may help mutual funds because it restores their capacity in providing long-term liquidity compared to same-index ETFs. If certain conditions are met, including optimal swing factor calibration, along with rational and forward-looking investors, swing pricing even enables mutual funds to dominate same-index ETFs in terms of liquidity provision.

Third, my paper suggests that regulators should avoid endorsing Vanguard-style multi-share class structures, where ETF and mutual fund share classes coexist within a single fund portfolio, especially when the underlying index consists of less liquid securities. This arrangement tends to favor mutual fund shareholders at the expense of ETF investors.

Anna Helmke is a PhD Candidate in Finance at The Wharton School.