The WIFPR Blog publishes posts spotlighting research by members of the Wharton community. In this post, Sergey Sarkisyan, PhD candidate in Finance, discusses his work on instant payments and the competition for deposits.

By Sergey Sarkisyan

The banking industry is highly concentrated. Despite the fact that there are 4,200 banks operating in the United States, the share of top-5 exceeds 50% of deposits. These large banks hold significant market power over deposits — they are able to pay very low deposit rates and yet keep most of their customers. One of the main reasons for high market power of large banks is the payment services that they offer. For example, large banks offer better credit cards, digital payment apps (e.g., PayPal or Zelle), and a wide network of ATMs and branches.

However, payment systems are developing, and they are becoming more efficient. One dimension of payment development is so-called instant payment systems (IPS). IPS are technologies for fast payments that are supposed to be accessible and cheap. Prominent examples include UPI in India, Pix in Brazil, and FedNow, which was launched by the Federal Reserve last summer. A unique feature of instant payment systems is low entry costs for all banks, not just large banks, so IPS might have the potential to change the competitive landscape among banks. In my recent paper, I show that instant payment systems increase competition for deposits among banks.

I use the introduction of Pix in Brazil to study the impact of instant payments on the banking landscape. Pix was launched by the Central Bank of Brazil in November 2020 for retail payments and transfers. To pay in Pix, the sender needs to scan a QR code, and the money will go instantly from the sender’s bank account to the recipient’s bank account. Having a bank account is necessary to use Pix, so the Central Bank mandated large and medium-sized banks to offer Pix. However, joining Pix was cheap, so most of the banks in Brazil joined the system within a few months. Pix also has many users — more than 70% of Brazilians use Pix, and it is currently the most popular payment method in the country, exceeding credit cards, checks, and cash.

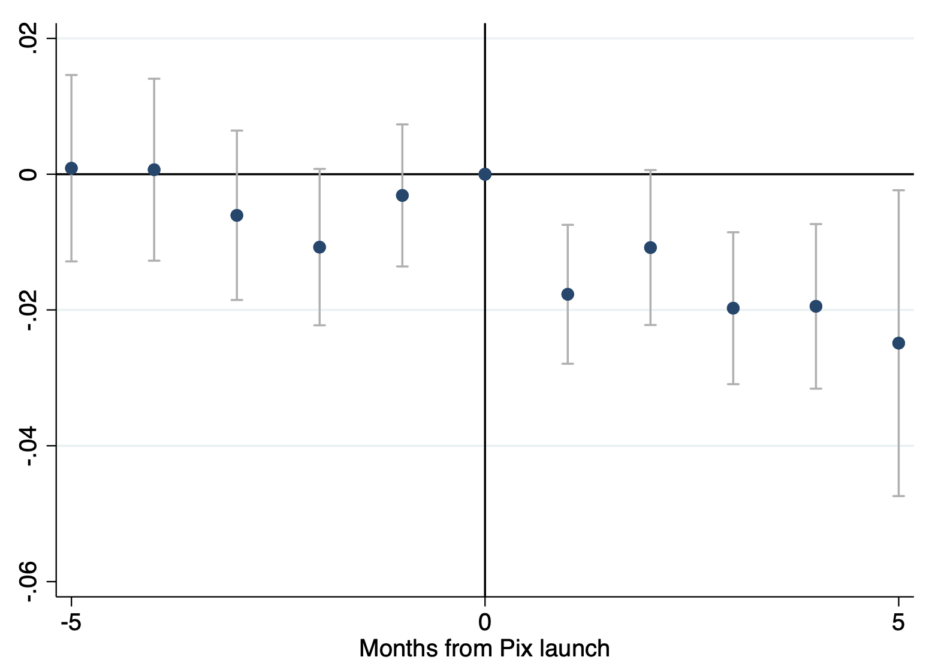

I use the relaxation of COVID-19 restrictions to generate plausibly exogenous variation in the use of Pix. I assume that Pix was used more in the areas without COVID restrictions due to higher economic activity and that COVID-19 restrictions did not have a direct impact on deposit concentration changes in November 2020. My study delivers three main findings. First, deposits of small banks rise relative to deposits of large banks because Pix allows small banks to offer greater payment convenience. More broadly, deposit market concentration declines in Brazil, as Figure 1 shows. A $200 increase in per capita Pix transactions would transform a municipality with five banks of equal size into a municipality with six banks of equal size — that is, deposit markets become more competitive. My findings are mostly driven by richer people who already have bank accounts and less so by previously unbanked, financially constrained people.

Second, since small banks gain an inflow of deposits by offering greater payment services, they no longer need to pay very high deposit rates to attract clients. I find that deposit rates of small banks decline relative to deposit rates of large banks after the introduction of Pix. Small banks then become more profitable and gain deposit market power — they are able to keep their clients with lower deposit rates and still be profitable.

Third, a structural estimation provides insights into deposit demand in Brazil. Generally, deposits are very sticky — changes to deposit rates do not make depositors move. However, after the introduction of Pix, deposit demand becomes more sensitive to changes in deposit rates. If one bank increases its interest rates while another does not, depositors are more likely to move to the first bank than they were before the introduction of Pix. The reason is that transferring money using Pix is free, so switching costs are significantly lower. I also find that the introduction of Pix had a positive effect on depositors’ welfare — the average depositor in Brazil would demand a $380 compensation to move back to the world without Pix.

My findings have several important policy implications. First, fast payment systems can significantly increase the competition among banks and hence, reduce banks’ market power. This can help monetary policy, which usually struggles to make banks change their deposit rates after policy rate changes. If households can easily switch banks to increase their deposit rates, then the banks will react by responding to policy rate changes.

Figure 1: Impact of Pix on Deposit Market Concentration: IV with Easing of COVID Restrictions

Second, the main reason why most banks joined Pix and why households use it is the way the Central Bank designed it. Specifically, unlike FedNow which is currently only available to financial institutions, Pix is a retail payment system, so households can use it to make payments. The Central Bank also mandated many banks to join the system, thus creating a big user base and avoiding low take-up by large banks — something that FedNow faces. Large banks already have the ability to create their own payment technologies (examples include Swich in Sweden and Zelle in the US), and for small banks, it is quite expensive to be among the first entrants, so it is vital to incentivize financial intermediaries to adopt the system to make it functional.

Sergey Sarkisyan is a PhD candidate in Finance at the Wharton School.